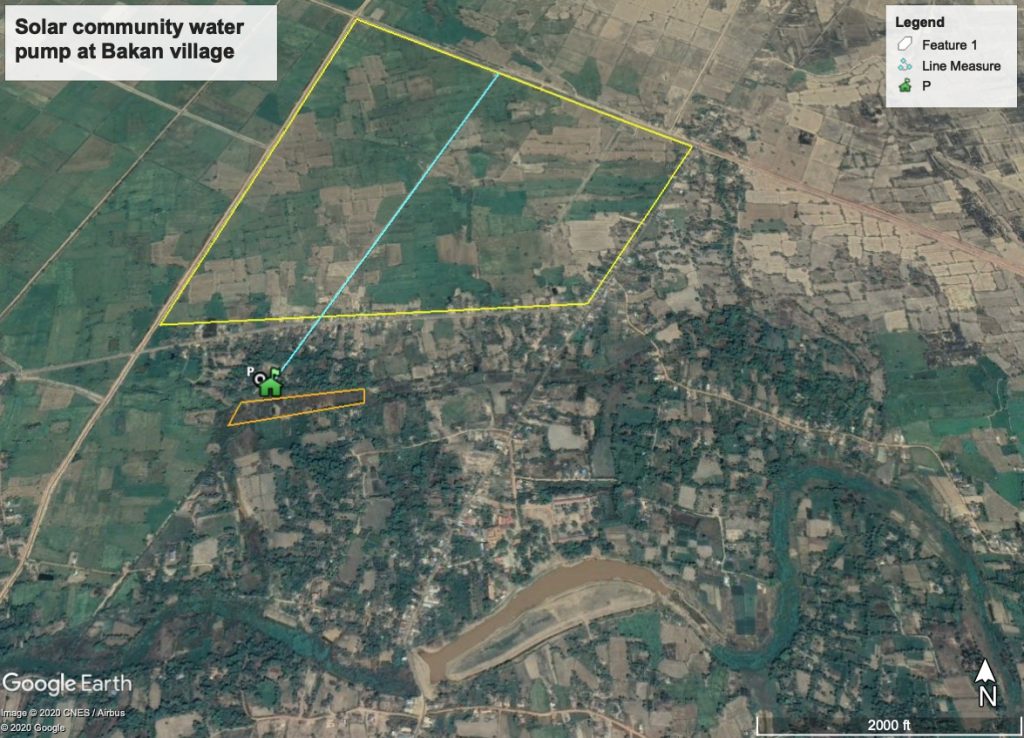

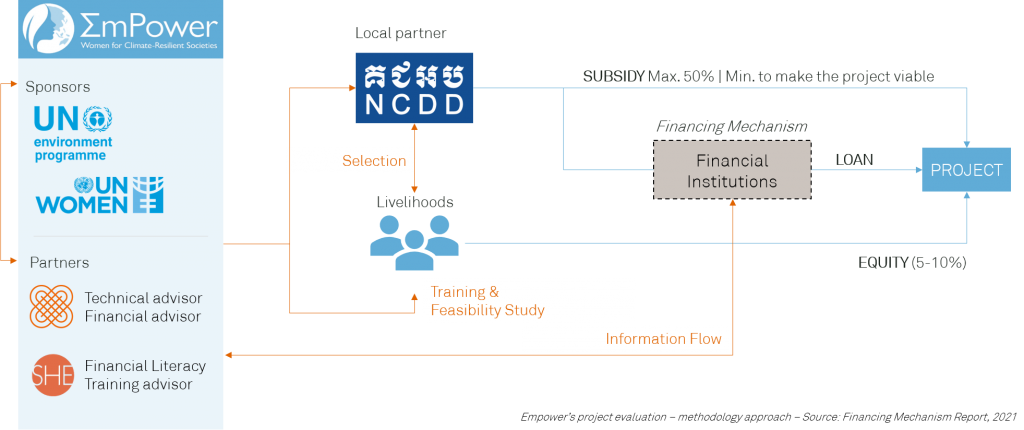

Since 2019, Nexus for Development (Nexus) has been working with the EmPower (Women for Climate Resilient Societies) Project alongside UN Environment Programme (UNEP – the financer), the Cambodian National Committee for Sub-National Democratic Development Secretariat (NCDDs – co-implementer), and SHE Investments (co-implementer). Nexus’ role in the EmPower project is twofold: (i) to identify feasible livelihood options that make use of renewable energy and which the Empower project could support, and (ii) to design a financing mechanism that could catalyze adoption of these livelihood options by women-benefitting enterprises. The types of women-led, small-scale renewable energy technologies explored within EmPower in Cambodia include solar water pumps, a community water pump, solar chicken incubators, cold storage, and other retail options.

The financing mechanism designed within EmPower was the focus of a recent online workshop hosted by Nexus for Development. The goal was to gather Cambodian financial institutions (“FIs”), technical providers, and other industry partners to discuss how to remove barriers to climate-resilient societies where women play an important role. Participants were introduced to the proposed financing mechanism designed to promote easier access to finance for renewable energy and women-driven businesses.

The proposed financing mechanism

The two main questions Nexus tried to address with the financing mechanism were: (i) how to leverage EmPower’s outputs – which include a renewable energy subsidy, feasibility studies, and financial literacy training – to facilitate access to financing alternatives that benefit women, and (ii) who would be best-placed financing partners for EmPower in its interventions?

Impact investing financing structures have taught us, both in literature and reality, that there are no objectively right or wrong models, but that the goal in developing any mechanism should be to find one that is best fit for purpose. This learning was in focus during the design of the proposed financing mechanism. We believe fit-for-purpose should always be a guiding force is developing financing structures.

Understanding the impact investing landscape

Many impact investing initiatives promoted by both development agencies and impact investors aim to demonstrate the commercial viability and bankability of an investment (for instance, a women-focused and low-carbon investment). Yet these actors often lack the requisite in-house expertise: collections, client relationship, local presence, and general loan agreement and portfolio management. For their part, FIs often have this expertise – having developed and benefitted from many instruments, processes, and regulatory frameworks – but have limited risk appetite.

In Cambodia, FIs increasingly show interest in sponsoring both women-driven and climate-resilient projects. It follows that the EmPower proposed financing mechanism, with its aim to create the incentives to promote a more socially inclusive and environmentally friendly financial ecosystem, should appeal. Indeed, several of the FIs participating in the financing mechanism workshop described themselves as “socially driven” and “interested in participating in the impact investing landscape”, mentioning that “women already represent a significant stake of FIs’ loan portfolios”. Yet, according to beneficiaries – those women and women-enterprises participating in the EmPower project – access to financing (including from FIs) is still identified as a significant challenge.

Barriers and opportunities

- Developing Know Your Client (KYC) and Due Diligence material

From a private sector engagement standpoint, a project like EmPower aggregates private entrepreneurs, such as women-driven SMEs and technical providers, while producing relevant information for KYC and due diligence procedures. It also provides technical assistance through the financial literacy training. This could be leveraged by any FI throughout its internal credit assessment. A financing mechanism could leverage these aspects of EmPower, by sharing information with selected FIs. That would be particularly welcome by FIs who report that when they themselves proposed financial literacy training as an eligibility criterion, potential borrowers tend to find other “less demanding” sources of funding.

- Considering flexible guarantees

Given that some potential borrowers might struggle with providing either a Guarantor or collateral for the loan, EmPower, through its local partner (NCDDs), would provide the needed guarantee through either a cash-backed or guarantor scheme, helping the merits of the project to overcome entrepreneurs’ constraints.

However, the interviews with FIs suggested different realities in terms of guarantee. While some consider that if there is a buy-and-back guarantee from the Technical Provider, they can accept equipment as collateral, others emphasized the legal constraints to monetizing these types of assets.

So, flexibility is another important aspect of a financing mechanism, as it allows the mechanism to operate with or without a cash-backed guarantee, with different types of Guarantors (public or private) and to sponsor either livelihoods or, for example, technical providers.

- Adopting inclusive collateral

Another important concept introduced by Nexus’ financing mechanism proposal is the one of “inclusive collateral”. Inclusive collateral comprises collateral that FIs are often reluctant to accept (or value poorly), such as moveable assets (e.g. sponsored equipment), forecasted revenues, and the concept of household assets (i.e. having women benefiting from their household’s assets, even if they do not have legal ownership). A guarantee mechanism would allow FIs to test these inclusive assets without altering their risk perception of the project/ borrower, while addressing the fact that lack of collateral is perceived as a barrier by women entrepreneurs. Lower collateralization could also be considered.

This said, some FIs interviewed when developing the financing mechanism mentioned that they are not just looking for guarantee schemes, but also for funding when proposing new deals, so it is important to keep in mind that sometimes projects need to come with funding to be considered interesting by the FIs.

Leveraging public-private engagement for projects to scale

Imagining and adopting new financing mechanisms is a long journey. Yet step by step, through pilots and appropriate support like within UNEP’s EmPower project, it happens. Based on the webinar discussion among relevant Cambodia actors including FIs and ESOs (entrepreneurship support organization), the relevance of promoting dialogue and the benefits of bringing “all aboard” when discussing climate change and women-businesses experienced barriers had broad resonance. Also, the readiness and willingness of FIs to look at projects such as the ones developed under EmPower was apparent. So were the challenges to building sound pipelines of finance-ready initiatives.

A new candidate financing mechanism is helpful, yet every FI brings its own challenges and reacts to different market stimuli. For some, it is funding that would best scale EmPower-like projects; for other others, the guarantee is not seen as a barrier to financing projects. For many, the fact of over-indebtedness in Cambodia is identified as a serious barrier for entrepreneurial initiatives.

In conclusion, the webinar suggested wide agreement that FIs are ready to play an even more active role in sponsoring impact-driven projects. There remains work to be done in promoting responsible borrowing through offering project developers skills in business management and risk mitigation. These together can catalyze a women-driven, climate-resilient transition.